About me

My name is Inaki (aka Nakitxu). I’m an Electronic Engineer, but I spent my entire carreer working as programmer. I wrote my first commercial game in assembler Z-80 when I was 14 years old (and I have been in this world over half-century)

Actually I have a partial time job as Industrial programmmer (I program machines and complete factories) but I had luck and learn about Bitcoin a few years ago and I could buy a few at low prices.

This circumstance forces me to think and learn about the technical analisys in all his variants (tired of be just a hodler!).

I have spent the last years learn every piece of trading system I found, while try to not loose all my money in the way 🙂

(If any moment you read any strange english, sorry for that, but english is not my first languaje)

Consensio trading system

It’s a propietary system from Tyler Jenks (Lucid Investments Strategies website), open now for the public through their videos on his hyperwave channel: (Hyperwave Youtube Channel)

Consensio trading system is a manner of use simple moving averages (SMA from now on…) to get rid of the price in your charts, and focus just in witch state is the asset… is in a Bull market?, bearish?, flat? without being affected for the noise of the rapid up and down of the price movement.

It’s very usefull used in long timeframes (1 day, 1 week or more)

Since my first knowdelegde of Consensio watching videos from Hyperwave channel, (I must admit, I did not watch the specific videos of Consensio…) I just keep the idea in my main: the idea of use 3 different SMAs to try to predict the status of the market, and see if I can come with some idea for write an Tradingview Indicator.

Tyler use to talk in their videos about check the SMAs, and in function of their movement, crosses and positional order of them, enter/exit from a trade, or buy more/shell shares to preserve (and gain) capital.

I think he has the ability of doing this just by hand, but, I will try to disect this technique to come with some useful tools (indicators) to work with.

Mi first Indicator for Consensio

In my first attempt, I try to use the positional order of 3 different period SMAs in order to get a «value» of how bearish or bullish is the current status of an asset.

The idea behind this is, in a bull market, the first SMA starting the ascension is the shorter period SMA, then the middle, then the long period SMA. In a Bear market is the opposite, first descend the short SMA, then the middle, then the long.

For example, to illustrate this, here we have a graphic example. There are 3 SMAs, green, yellow and red, corresponding (and in this order) to short sma (period of 3 values) , medium (7 values) and long (30 values):

As we can see, the price is going up, then the 3 SMAs are going up, but the first to raise is the green, then the yellow (medium) and finally the long term SMA.

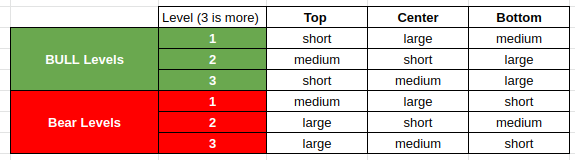

So… with this idea, we can «categorize» the positional order of the 3 SMAs, and get a «level» value than indicates if the asset is Bull or Bear with 3 levels of «intensity».

The following table show these combinations and the associated levels:

With this idea in my main, I came up with my first Consensio indicator (well, my second one, my first one just show the 3 smas… nothing more, so nothing to mention specially)

Consists in an overlay indicator (so share the space of the price graphic) and shows the 3 SMAs (very important include this so we dont waste slots for insert more indicators, you know… there is restrictions in TradingView regarding how many indicators you can set simultaneously in your graphic) and several labels, indicating any change of the level of Bullness/Beariness of the asset. Tese labels are show in the upper part of the indicator.

Here you have an example:

In the upper part of the picture you can see the labels showing the Bull/Bear levels (only shows a new label when the value changes)

The idea is open/close or increase/decrease your exposition to the asset in function of these levels.

The amounts of the positions is up to you.

If you wanna play with this indicator, you can (It’s open for everyone), you can find it in this URL (TradingView): Consensio With Signals (It’s name in Trdingview Library is «Consensio with Signals»)

Later I develop a second version of this indicator, this time include 2 forecasted values: calculate 2 more values for the 3 SMAs, supposing that the price doesnt change (but removing the first values in the calculation of the SMAs). You can find (and use) this versión in this URL: Consensio with Signals Forecasted (the name in Tradingview public library of indicators is «Consensio with Signals Forecasted»)

In this URL you can find All of my published scripts in Tradingview: Nakitxu’s Tradingview Indicators, for now, all of them are open to the public.

Don’t hesitate in leave any comments of suggestions (and push the like & follow button… it helps)

0 Comentarios.